Get $1 Million In Your Retirement Savings

Uncle Sam wants people to save. In fact, the government provides some pretty big incentives to encourage savings. The best way to get to millionaire status is saving money in your retirement account. Save Regularly To get to $1 million in your retirement account, it's...

The Pros of Paying Down Your Mortgage

Owning a home is a wonderful accomplishment, but it’s not without its detriments, especially when it comes to costs. One of the most intimidating things about homeownership is keeping up with the mortgage. Payments can either be made gradually or all at once if that’s...

How You Should Invest Large Sums Of Money?

Certain individuals are fortunate enough, either through earnings or inheritance, to possess large sums of money. In many instances, these funds are not intended to be spent immediately but invested with designs on yielding the investor greater returns at a later...

Why NOT to Max Out Your Retirement Account

The prevailing wisdom is that workers who have access to 401(k) and 403(b) plans should max them out as soon as possible. It's easy to see why this makes sense on the face of it. Retirement savings are a crucial issue for many Americans. Under-saving can have real...

How You Can Save Money When Filing Taxes

Introduction Everyone has to pay their fair share of taxes when they are earning an income. Tax revenues are used to provide public education, build infrastructure, and promote many services that are used by the public. However, taxes can be overwhelming at times and...

Money Mistakes That Everyone Makes

Efficient money management is a key skill. However, not all people execute this task effectively. In fact, many of us frequently make costly but avoidable mistakes such as: Making Purchases One Cannot Afford Everyone is guilty of purchasing a small ticket but...

The Senior Citizen Tax Form

Seniors will find it easier to file federal income tax forms for the 2019 tax year. The new form, courtesy of the Internal Revenue Service (IRS), enables seniors to file their federal taxes more efficiently. Form 1040-SR consists of larger print and the elimination of...

How To Prepare For A Recession

Can A Person Make Themselves Recession-proof? With a tariff war developing, prices in the United States will probably rise soon. Because the United States has become so dependent on China for cheap products, tariffs against China will affect many consumer goods. This...

A Day in the Life: Accountants

The interesting thing about being an accountant is that no two days will likely be the same. So, technically speaking, this article should really end here. But instead, I’d like to offer you an idea of some of the common things you can expect if you become a...

How to Hire Your Perfect Accounting Team

When building a business, you want to surround yourself with talent. That’s what will get your business off the ground and into the stratosphere. Regardless of your business, you will more than likely need multiple departments to succeed, especially a...

The Official Blog of Kewho Min

Get $1 Million In Your Retirement Savings

Uncle Sam wants people to save. In fact, the government provides some pretty big incentives to encourage savings. The best way to get to millionaire status is saving money in your retirement account.

Save Regularly

To get to $1 million in your retirement account, it’s important to save on a regular basis. Putting a few bucks aside here and there will not usually get you to the desired level of wealth. Starting earlier in life will usually get you closer to the magic $1 million number because of the power of time and compounding interest.

Save Automatically

People are more likely to do things when they don’t have to make a decision. President Obama and other powerful people have admitted that they have very limited work wardrobes. The decision-making process takes quite a bit of energy so many successful people wear a clean version of the same thing every day. They effectively make this automatic. Saving automatically for retirement will help you ensure that you actually get around to saving. By putting money away before you have a chance to spend it, you’ll be less likely to miss it, and it will start to grow over time.

Invest Your Money

Saving is good, but over time, investing your money will lead to better returns. Over the past few years, the return on simple savings accounts has been less than 1% per year. That will not compound very rapidly, and stashing money in a savings account will actually cause you to lose purchasing power because of the power of inflation. Instead, after stashing a decent emergency fund, you’ll want to invest your retirement savings. By investing in a good stock mutual fund, you could expect to get anywhere between 7% and 10% over the long haul because of business growth and dividend payments. This will allow your money to work for you and grow to a healthy sum.

By starting early, you can build your nest egg with small sums. Investing around $300 a month over a 40-year working career should get you in the neighborhood of $1 million as long as you get an 8% average return. If only have a 10-year period left, you’d need to save a little more than $5,500 a month to reach the same level of retirement savings. Using tax-advantaged retirement accounts is a important key to building your retirement savings. All of the money stashed can grow without any immediate tax liability. If you invest in a taxable account, you’ll have to pay taxes on capital gains and dividends. This is on top of your regular income taxes. Starting early and saving automatically will help you grow your savings. Eventually, you might even wind up with a retirement account worth $1 million.

The Pros of Paying Down Your Mortgage

Owning a home is a wonderful accomplishment, but it’s not without its detriments, especially when it comes to costs. One of the most intimidating things about homeownership is keeping up with the mortgage. Payments can either be made gradually or all at once if that’s an option and truly, that isn’t always the case for most people. So, how can paying down the mortgage be beneficial, and what are some clever and strategic ways to go about making these payments as efficient as possible?

One of the pros of paying off the mortgage is early is saving money on interest, but on the other hand, allowing payments to be stretched further means a better return on investment and credit building. Realistically, both of these ideas are pros depending on the situation, and either of them can go in tandem with a predetermined course of action. However, a swifter plan to consider would be higher monthly payments that will accumulate a decent rate of return over the course of years. Regular payments can lessen the amount of interest that will be owed in the long run. Remaining consistent on payments will help with reducing that. Mortgages can oftentimes be accompanied by other fees that add up rather quickly, like an insurance plan for the mortgage itself, which, in some cases, lenders will require homeowners to have if a 20% down payment isn’t made upon initial home purchase. What’s more, being a homeowner in a financial environment that has the potential to face both inflation or deflation at any given time should be another pro reason to consider consistent down payments. One of the most obvious pros in all this is the potential for financial freedom. Having a dwindling mortgage due to a set plan means more money available for everyday life and possibly even the beginning of a new savings account.

From smaller interest rates to building credit and saving more money, paying down the mortgage in as short of a timeline as possible has a significant amount of benefits. While these factors may seem minor, their overall impact and advantage far outweigh the excess fees and costs that are inevitably bound to surface as a homeowner!

How You Should Invest Large Sums Of Money?

Certain individuals are fortunate enough, either through earnings or inheritance, to possess large sums of money. In many instances, these funds are not intended to be spent immediately but invested with designs on yielding the investor greater returns at a later time. Financial experts suggest that those possessing significant finances consider the following investment strategies:

Consider Long And Short-Term Financial Needs

Prior to committing to any particular investment strategies, financial professionals encourage prospective investors to consider their investment goals over the short and long-term. Certain investments are made for the purpose of burgeoning the invested funds over many years. Others can yield much quicker yet still profitable returns. The would-be investor needs to determine how much money they need from their investments. For example, if the individual in question earns a solid income, long-term investments might be better suited. However, if another prospective investor is retired or has major expenses, short-term goals are a more likely pursuit.

Once such goals are established, the investor can consider specific investment avenues. Such opportunities can include:

Mutual Funds

Financial experts opine that mutual funds are typically a safer investment method than stocks. Investing in such entities might not yield significant increases in principle but investors usually are not at risk of losing large sums of cash as they might when placing their money in more aggressive investments like stocks.

Establish An Emergency Fund

No one desires or necessarily expects bad times to befall them. However, unexpected and potentially harsh events can impact a person’s life. An individual could lose their job, become injured or be forced to defray the costs of a loved one’s major illness. Should these circumstances arise, an emergency fund could prove paramount to financial survival and recovery. In many cases, an emergency fund will include anywhere from six months to a full year of basic, current expenditures like rent, insurance, utilities and food money that is placed into a simple savings account.

Add To An Existing Work-Related Retirement Account

When in doubt, placing funds in one’s already existing company-sponsored retirement plan could prove beneficial. For example, placing additional funds into a 401(k) typically yields and quicker and more significant growth in an asset that will prove vital when the individual in question can no longer rely on a steady income.

Why NOT to Max Out Your Retirement Account

The prevailing wisdom is that workers who have access to 401(k) and 403(b) plans should max them out as soon as possible. It’s easy to see why this makes sense on the face of it. Retirement savings are a crucial issue for many Americans. Under-saving can have real repercussions for the future, especially as life expectancies are increasing while the retirement age stays put at 62 to 65.

However, there are some situations where it’s best not to max out a retirement account, or at least not max it out as quickly as possible. Take, for example, a high earner whose company also offers a retirement savings match as a benefit. These matches are typically calculated as a percentage. A worker who funds their account too quickly can actually lose out on matching contributions due to the way they’re calculated. For example, if someone hits their max ($19,000 for most workers in 2019) in October or November, they could lose hundreds of dollars in matching funds. So it’s important to calibrate retirement contributions carefully.

Another consideration is the amount of debt that a given employee is carrying. Typical 401(k) and 403(b) accounts have a return of about 7%. This is certainly better than a standard savings account. It’s more than the interest percentage on student loans. However, it’s much less than the going interest rates for many credit cards. Saving at 7% while accruing more debt at 16%-21% just doesn’t make sense. Compound interest, in this case, works against the investor. In such a case, it can be beneficial to dial back on savings contributions, in favor of clearing up bad debt first. For employees who have a company match, depositing some money may be prudent. But it’s not a great decision to max the account out.

Finally, every employee should take a close look at the investment options offered by their company’s 401(k) or 403(b). Not all plans are created equal. Some offer ten or more different funds for selection, and even allow the saver to allocate by percentage. Others focus on company stock, or offer broad descriptions like conservative or high-risk. If the 401(k) on offer isn’t great, it’s always fine to open an IRA.

How You Can Save Money When Filing Taxes

Introduction

Everyone has to pay their fair share of taxes when they are earning an income. Tax revenues are used to provide public education, build infrastructure, and promote many services that are used by the public. However, taxes can be overwhelming at times and it can be disheartening to see how much of an income goes towards taxes. There are a variety of strategies that taxpayers can use to save money as they are filing their taxes. It is best to consult with an accountant prior to embarking on any tax-saving journeys, as accountants can provide the best legal tips for a person to save money based on their individual situation.

Make Donations

Donating is a great service that allows disadvantaged people to receive many things that they may need. Taxpayers who have eligible assets can donate securities to a charity through a fund. Depending on the fund used, the securities will be tax-deductible and will allow for deductions on a person’s adjusted gross income (AGI). The donations will prevent capital gains from being taxed from a person.

Harvest Losses

Realized losses from the sale of the security can be used to offset capital gains made from another investment. Depending on the strategies, larger realized losses can be utilized in future years for tax purposes. A taxpayer will need to match up similar losses and gains to one another to make the deductions eligible for use. Tax-loss harvesting is best used by investors who are already considering selling certain assets in order to make changes to their portfolios.

Max Retirement Plans

Many retirement plans are tax-deferred and don’t require taxpayers to pay taxes on the money in the investment accounts until they are retired. For taxpayers who haven’t added the maximum amounts into their retirement plans, it is best to add more income into the plans to prevent taxation on the funds. Pre-tax contributions through an employer allow a person to decrease the amount of their taxable income while investing money for their future.

Give A Bonus

For taxpayers who own their own businesses, a self-given bonus can allow the owner to increase their employer-side retirement income. The abilities will depend on the type of retirement account that the owner has.

Money Mistakes That Everyone Makes

Efficient money management is a key skill. However, not all people execute this task effectively. In fact, many of us frequently make costly but avoidable mistakes such as:

Making Purchases One Cannot Afford

Everyone is guilty of purchasing a small ticket but expensive item from time to time. However, buying major luxuries one cannot yet afford could precipitate serious financial troubles. Financial experts suggest avoiding purchasing significant items such as homes and vehicles until the individuals in question have the assets necessary to pay for these items without incurring too much debt or sacrifice.

Living Off Credit Cards

Many people obtain numerous credit cards and accumulate significant balances on these accounts. Over time, paying down these accrued debts presents greater difficulties and might interfere with a cardholder’s ability to address other pertinent expenses. Financial advisors strongly discourage credit cards use to finance most or all expenses. Such professionals suggest that credit accounts should be used for only a few purposes such as emergency expenditures, obtaining and building credit, accruing reward points and for on occasional splurge.

Failing To Live Below One’s Means

On the contrary, many people experience financial difficulties because they live well above their means. Financial experts strongly advise everyone to live below their means. Attaining this goal means spending money on only pertinent expenses like food and bills. Unnecessary expenditures should be avoided at all costs.

Failing To Save Money

Granted, for individuals living on fixed incomes or a certain degree of expenses, saving money can present a challenge. That said, financial officials stress that saving money as early and often as possible is a crucial step to avoiding economic hardship. Savings need not always be pronounced. However, such action must be taken and performed consistently.

Having Only One Income Stream

Many people believe their professional income is enough to provide financial sustenance. That said, financial professionals opine that individuals should establish some type of second income as soon as the opportunity presents itself. No, this does not necessarily means getting a second job. Economic experts recommend investing money in endeavors like interest bearing accounts, stocks or real estate.

Taking No Action

Financial advisors opine that amongst the worst actions individuals can take is no action. As early as their 20s and at frequent intervals thereafter, individuals should continually assess their financial circumstances and make the appropriate additions or subtractions when necessary.

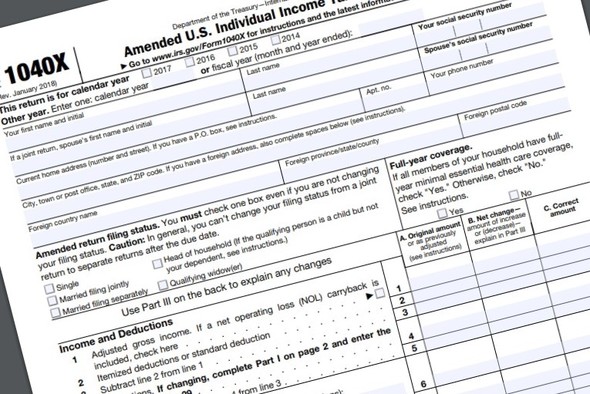

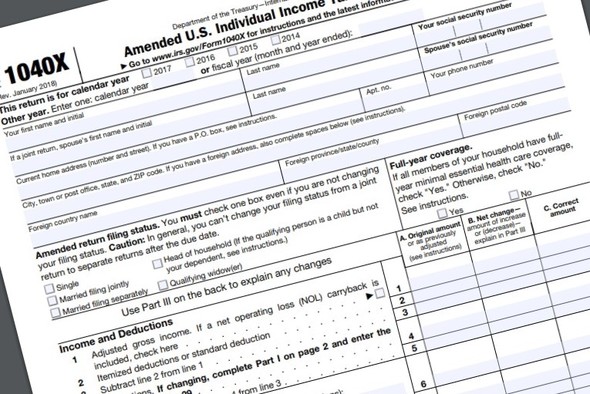

The Senior Citizen Tax Form

Seniors will find it easier to file federal income tax forms for the 2019 tax year. The new form, courtesy of the Internal Revenue Service (IRS), enables seniors to file their federal taxes more efficiently. Form 1040-SR consists of larger print and the elimination of shaded areas surrounding the boxes. The form will also include a Standard Deductions Chart. In 2018 and previous years, the tax form did not include a Standard Deductions Chart. Instead, seniors had to research their deductions in a separate pamphlet.

Many Seniors Will have a Chance to Pay their Taxes without any Difficulties

Form 1040-SR is still in the formative stages. The new senior tax filing form will emerge as a result of U.S. Congress legislation insisting that the IRS allow seniors to file their tax forms without needing to pay for an accountant. Many seniors wish to handle their financial affairs without any outside assistance. The form’s purpose is to cater to seniors who do not use computers and prefer filing traditional paper tax forms.

Form 1040-SR Offers Seniors a Better Way to File Tax Forms

Millions of senior taxpayers may benefit from the new tax form. The AARP has already endorsed the form. The new 1040-SR tax form is similar to the newly extinct 1040-EZ form. Seniors who have earnings from capital gains and dividends can use Form 1040-SR. Seniors receiving annuities, pensions and distributions from Individual Retirement Accounts (IRAs) will benefit from using the simplified form. Plus, seniors who take care of dependent children or grandchildren can take the child tax credit on Form 1040-SR.

Self-employed Baby Boomers must use Form 1040

Self-employed seniors are not permitted to use Form 1040-SR. Instead, they need to use Form 1040 that includes Schedule C. Seniors who itemize deductions will need to use the standard Form 1040. The Bipartisan Budget Act of 2018 is the final result of the congressional battle to help seniors pay their taxes without experiencing any issues. The new form is easier to read and makes filing taxes less burdensome to numerous older seniors. One catch is that a person must reach the age of 65 before January 1, 2020 to qualify. Otherwise, they will need to file Form 1040.

How To Prepare For A Recession

Can A Person Make Themselves Recession-proof?

With a tariff war developing, prices in the United States will probably rise soon. Because the United States has become so dependent on China for cheap products, tariffs against China will affect many consumer goods. This includes many toys, household products, and even some foods. Rising prices can quickly outpace earnings and force Americans to tighten their belts. How can the savvy consumer prepare for a possible recession?

What Not To Do

It is a good idea to stock up on necessary goods now so that the immediate impact of a recession on a family is reduced. It is not a good idea to go into debt buying up those items. This places a burden on a family’s budget right when they need to free up as much income as they can.

Maintaining a calm outlook during a recession improves the individual’s life during the uncertainty of financial downturns. Recessions can cause serious mental and physical health issues which may require medical attention. Stay healthy in mind and body, and fewer emergencies will surprise an individual.

Smart Moves

Act now to improve three significant areas in life:

- Reduce debt

- Invest in your health

- Build interpersonal connections

The wise individual will pay down their higher-interest debt first. They can invest in their health by eating healthier, exercising, and getting enough sleep. This reduces medical costs. It also improves the physical and mental resources a person has available for dealing with a stressful situation.

The individual can build faith-based relationships, network within their business, and connect with fellow hobby enthusiasts. This support can make a significant difference in how a person reacts to a recession.

Refocus And Reprioritize

Every budget can use some streamlining. Prioritize expenses and financial goals. Work together. A daily goal might be to eat breakfast at home rather than paying for an unhealthy meal at the drive-thru. An annual goal might be to purchase birthday or holiday gifts before prices rise. Focusing on personal experience rather than possessing material goods can also help. Spend less and save more. Periodically, increase efforts in both of those areas.

A Day in the Life: Accountants

The interesting thing about being an accountant is that no two days will likely be the same. So, technically speaking, this article should really end here. But instead, I’d like to offer you an idea of some of the common things you can expect if you become a full-fledged accountant.

The first thing to note for the entire accounting industry is that your entire schedule is based on the time of year. Your day-to-day work life has the potential to be very cut and dry and, quite honestly, relatively slow, at least for the majority of the year. However, once tax season rolls around (approx. January 1 – April 15), things can get hectic. You’ll especially notice an uptick in work towards the end of the season, seeing as how a large majority of Americans wait until the last minute to file their taxes. This time is probably the most busy you’ll be all year, depending on the firm you’re working for.

You can expect work hours to range into the double digits on weekdays, and maybe even a few extra hours on the weekend. You’ll mainly be working on auditing and collecting the appropriate information. Don’t let that stress you out; once tax season is over, you can likely enjoy a nice long vacation, again, depending on your firm.

Now, outside of tax season, that’s when your daily schedule will vary drastically. For example, Certified Public Accountant, Amy Zhang, is the founder and CEO of her own firm, and as the CEO she has a variety of tasks to complete within the month. She regularly checks client emails in the morning, then moves on to keeping up with the industry by reading multiple publications in accounting for about two hours. Afterwards, she takes that information and disseminates it through the firm’s social media accounts, ensuring that the public knows that her firm has its thumb on the pulse of the industry.

She will then spend another couple of hours in the day dedicated to networking and marketing. She does this by attending various conferences and meeting with clients, both current and prospective.

This is only one example of how a CPA’s day can look. Obviously, your mileage will vary. If you’re starting your career, then your day will have a bit more structure and, admittedly, repetition. But once you’ve earned your stripes, so to speak, then you’ll see some variety.

How to Hire Your Perfect Accounting Team

When building a business, you want to surround yourself with talent. That’s what will get your business off the ground and into the stratosphere. Regardless of your business, you will more than likely need multiple departments to succeed, especially a finance/accounting department. So how exactly can you attract top-notch financial talent? Here are some tips and tricks.

Be Clear on Your Company

Chances are, if you’re reading this, you’re running a small-to-mid-sized business. There’s nothing wrong with that at all. But, if you’re on the smaller side, then prospective employees probably aren’t terribly familiar with your company. And you need to communicate that. Clearly. No one wants to step into a new job at a company only to find out a month later that the company isn’t a proper fit. So, before you even enter the interview process, make your company’s vision and brand very clear through websites, promotions and general public-facing content. Showcase your company culture, and you will find the right people.

Network

This may sound like common sense, but utilize your network. It’s a great way to bring in top-notch content. You’ve hired the best of the best, right? Chances are your employees associate themselves with like-minded, top-notch individuals as well. So take advantage of those connections. Ask employees for any leads on new faces that can perform the needed duties. It can also cut down the hiring process, which is helpful for everyone.

Clarify the Job Description

Prospective employees need to know what they’re applying for. Again, no one wants a “bait and switch” situation on their hands. If you can craft a thoughtful job description, with duties and responsibilities for the immediate and near future, then job seekers should have a clear understanding of what they’re getting themselves into. If your company is small, then there’s a high chance for rapid change and growth, and employees need to be alright with that. Make that clear. Transparency with all employees, even the soon-to-be ones, is key.

Admittedly, these tips can be used for just about any department, but you’ll need a strong financial/accounting team in order to thrive. Make sure to follow these tips and find your superstars.