Once again, it’s tax season. For many Americans, they wait until much closer to April 15th (technically April 18th this year, since the 15th falls on a Saturday). Unfortunately, waiting until too close to when taxes are due can make you lose money that you would have otherwise gotten back. Instead of waiting until the last minute and stressing about completing your tax return, here are some reasons why you should definitely take care of filing your taxes as soon as possible.

Faster refund

One of the benefits of filing your taxes as early as possible is that you’ll get your refund much more quickly. It can take weeks to see your tax return and that’s valuable money you could be using (sometimes, it can be a few thousand!). If you file your tax returns electronically, you’ll get your refund sent directly to your bank account, often weeks sooner than it would have been sent by mail.

Get information for other sources

For people who are planning on purchasing a house, applying for financial aid, or need a record of their household income, filing taxes early will allow you to complete all of this information by whenever you’d need it. You can start your other paperwork ahead of time and stay on top of filling it all out.

Won’t need an extension

Frequently, people apply for an extension on their taxes, usually citing financial difficulties and needing more time to gather the funds for paying their taxes. Instead of not enough money being an issue, it’s often a lack of organization or familiarity with what was needed. Starting early with filing your taxes gives you time to find any deductions you can use and papers you may need, so you avoid an extension and possible penalties that could cost you even more money.

Prevent identity theft

Identity theft occurs to numerous people each year during tax season. If your Social Security number was stolen at some point in the past, the thief can use it to file a false tax return and collect your tax refund, completely messing with your filing. These false claims occur early on in tax season, so filing your taxes sooner will prevent someone else from getting what’s owed to you.

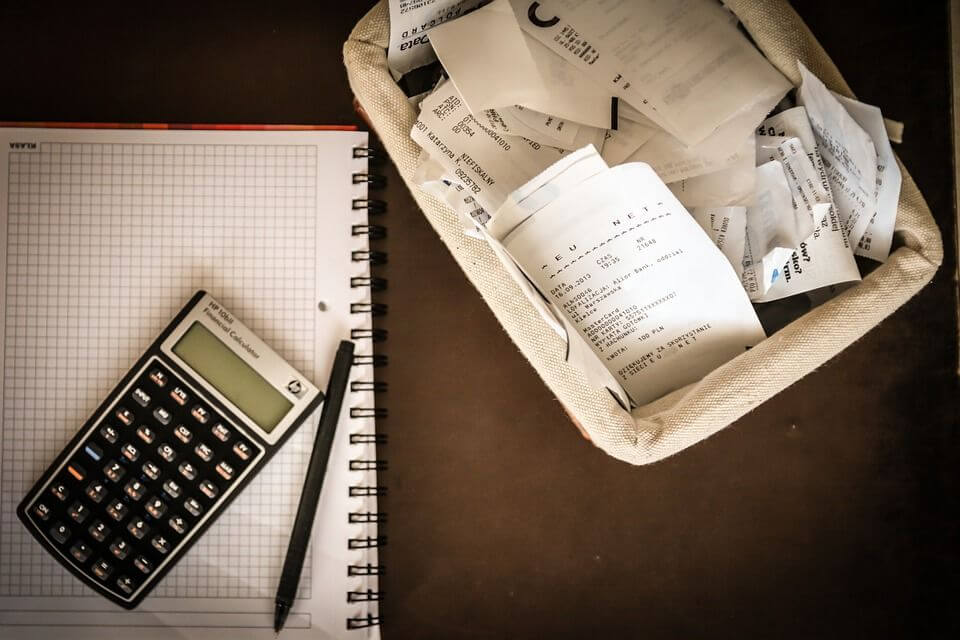

Familiarize yourself with what’s needed

By filing early, you’ll have plenty of time to get together anything you might not already have to file taxes. If you need to familiarize yourself with new tax codes or find receipts or proof of deductions, you have weeks to gather these items if you start your taxes early instead of waiting until a week before your taxes are due.